Thinking About a C Corporation?

Wow! The C Corporation tax rate dropped all the way to 21%? You must be thinking that this must be the best structure for my business.

Nope. And here’s why….

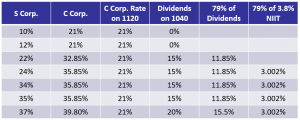

This table breakdown will give you a great look at how you would pay taxes on your bottom line. We’re going to compare the S-Corp v. the 21% C-Corp.

Let’s walk through a quick overview:

Mary is in the 34 percent tax bracket, and generates $100,000 in profit from her business she works in everyday.

If Mary operates as an S-Corporation, the profits roll down to Mary on a K-1 and Mary pays her individual 1040 taxes at the 34% tax rate. All for a grand total tax on Mary’s S corporation profits of $34,000.

If Mary operates as a C corporation, tax is imposed in two stages. First, the profits are taxed at the C-Corporation level at 21%.

- Total tax of $21,000.

- $79,000 is left of the $100,000 for distribution as a dividend to Mary.

Mary want’s her money now and this means she will issue dividends to herself. Here is where the second stage kicks in. Starting with the dividend tax of 15 percent, this creates:

- $11,850 in tax ($79,000 x 15 percent)

Mary’s tax bracket also triggers the net investment income tax (NIIT) that applies because of her dividend income. The NIIT is $3,002 ($79,000 x 3.8 percent).

As a C-Corporation, Mary’s total federal taxes on the $100,000 of income are $35,852!

The breakdown:

- C corporation taxes of $21,000

- 1040 dividend taxes of $11,850

- 1040 NIIT of $3,002

* In the S corporation column, the tax rates are for individuals.

* In the S corporation column, the tax rates are for individuals.

The S-Corporation is the winner. With the same $100,000 profit, Mary saves $1,853 by operating as an S-Corp v. a C-Corp.

Why is there a net investment income tax (NIIT) that applies to the C-Corp structure and not the S-Corp?

Participation.

If Mary materially participates in the S-Corporation, the NIIT does not apply to the pass-through income derived from active business operations.

Based on the tax rates alone, Mary should not be looking to switch to a C-Corporation due to tax reform.

Stay Connected!

Sign up to our newsletter today