You Don’t Need to Move to Florida

Tell Your Parents. You can retire in NJ and keep your money.

Apart from the warm weather, baby boomers are flocking to the sunshine state to avoid paying the high New Jersey taxes.

Quick Notes on What to Know:

- Be over 61

- Make less than $100k (usually not a problem for retirees)

- There is a phase in until 2020 where you will be free and clear from paying NJ income taxes. (we’ll chat on that later)

- Applicable for these retirement income types:

- Pensions

- Annuities

- 401k & IRA

- *Social Security benefits are already state income tax free 🙂

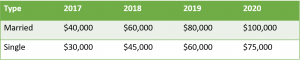

In 2017 you can deduct the first $20k of your income. (If you make less than $100k) In 2018, deduct $60k and so on…

Now all of this good news goes away if you make over $100k in retirement. The exclusion 100% goes away. 🙁

If you are 62 in 2020 and have $100k in retirement income, you pay ZERO New Jersey state income tax. If you happen to make $100,001 you now have a NJ tax bill of about $4,000. So make sure to watch this threshold carefully and may require some tax planning to keep you on track.

Stay Connected!

Sign up to our newsletter today