Business Meals are Dead

No more fun. Lawmakers killed off business meals deductions for directly related and associated entertainment. This took effect January 1, 2018.

Last year, you could take a prospect or client to a business dinner followed by a ballgame and deduct 50 percent. Now you can’t.

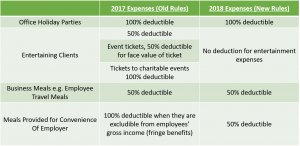

Here’s a quick snapshot of what sunset on January 1, 2018:

- Business meals with clients or prospects

- Golf

- Tickets to football, baseball, basketball, soccer, etc., games

- Grabbing a coffee

Here’s What Has Changed

&

What Hasn’t….

What are meals that are for the “convenience of the employer”? Meals served:

- at required business meetings on your business premises;

- at required business meetings in a hotel or other meeting place that passes the test for business premises but is located outside of the office;

- to employees who are required to staff their positions during breakfast, lunch, and/or dinner times;

- to employees at in-office cafeterias

For 2018, you need an account in your chart of accounts that says something along the lines of “Meals 50% deductible.” In this category, you can group together travel meals and the meals I mentioned above.

In spite of the elimination, you are likely to continue taking your clients to a ballgame and dinner. Just don’t expect it to save you any tax dollars.